When it comes to owning a home, one of the most significant decisions you’ll face is whether to build a house from scratch or buy an existing one. This question is not just about personal preference—it’s also about affordability, time, and long-term financial implications. Many potential homeowners find themselves asking, “Is it cheaper to build or buy a house?”

Understanding the Basics of Buying vs. Building a House

Before we get into the numbers, let’s break down what it means to buy or build a house. Each option comes with its own set of processes, advantages, and challenges.

What Does Buying a House Involve?

Buying a house is the more traditional route. It involves finding a property that’s already built, negotiating a price, and completing the purchase process. Here are some key points to consider:

- Pros of Buying a House:

- Convenience: The process is faster since the house is already built.

- Established Neighborhoods: You can choose homes in mature areas with schools, parks, and amenities.

- Lower Stress: No need to manage construction or deal with contractors.

- Cons of Buying a House:

- Limited Customization: You’re stuck with the design and layout of the existing home.

- Potential Repairs: Older homes may require costly maintenance or renovations.

- Competitive Market: In high-demand areas, bidding wars can drive up prices.

What Does Building a House Involve?

Building a house means starting from scratch. You purchase land, hire architects and contractors, and oversee the construction process. While this option offers more control, it also comes with unique challenges.

- Pros of Building a House:

- Customization: You can design your dream home to fit your exact needs.

- Energy Efficiency: New builds often include modern, energy-efficient materials and systems.

- Lower Maintenance Costs: Everything is brand new, so repairs are minimal in the early years.

- Cons of Building a House:

- Time-Consuming: Construction can take months or even years.

- Stressful: Managing contractors, permits, and unexpected delays can be overwhelming.

- Land Costs: Finding affordable land in a desirable location can be a challenge.

Key Differences Between Buying and Building

Factor: Buying a House, Building a House

Time Frame Faster (weeks to months) Longer (6-12 months or more)

Customization Limited High

Control Minimal Full

Upfront Costs Lower (but may include repairs) Higher (land, permits, materials)

Stress Level Lower Higher

Upfront Costs Comparison

One of the most critical factors in deciding whether to build or buy is the upfront cost. Let’s break it down for both options.

Costs of Buying a House

When you buy a house, the upfront costs typically include:

- Purchase Price: The most significant expense. In 2025, the median home price in the U.S. is around $400,000, though this varies by location.

- Closing Costs: These include fees for inspections, appraisals, title insurance, and more. Expect to pay 2-5% of the home’s purchase price.

- Agent Fees: Real estate agents typically charge 5-6% of the sale price, split between the buyer’s and seller’s agents.

- Inspections and Repairs: Older homes may require immediate repairs or upgrades, adding to the initial cost.

Costs of Building a House

Building a house involves a different set of expenses:

- Land Purchase: The cost of land varies widely depending on location. Urban areas are more expensive than rural ones.

- Permits and Fees: You’ll need permits for construction, zoning, and utilities, which can cost thousands of dollars.

- Materials and Labor: These are the most significant expenses. Material costs fluctuate based on market conditions, and labor shortages can drive up prices.

- Architectural and Design Fees: Hiring professionals to design your home adds to the cost.

- Unexpected Costs: Weather delays, material shortages, or design changes can increase your budget.

Typical Price Ranges

- Buying a House: $300,000 – $500,000 (depending on location and size)

- Building a House: $350,000 – $600,000 (including land and construction)

Long-Term Financial Considerations

While upfront costs are essential, don’t forget about the long-term financial implications of your decision.

Maintenance and Repairs

- Buying: Older homes often require more maintenance, such as roof repairs or plumbing updates.

- Building: New homes typically have lower maintenance costs for the first 10-15 years.

Energy Efficiency

Newly built homes are often more energy-efficient, thanks to modern insulation, windows, and appliances. This can lead to significant savings on utility bills over time.

Property Taxes and Insurance

- Buying: Property taxes are based on the home’s assessed value, which may be higher for older homes in established neighborhoods.

- Building: Taxes may initially be lower for undeveloped land, but will increase once the home is built.

Resale Value

- Buying: Established homes in desirable neighborhoods may appreciate faster.

- Building: Custom homes can have high resale value, but only if they’re built in a sought-after area.

Market Factors Influencing Affordability

The real estate market plays a huge role in determining whether it’s cheaper to build or buy.

Current Real Estate Trends

- Home Prices: In 2025, home prices will remain high due to limited inventory.

- Construction Costs: Labor shortages and material price fluctuations have driven up construction costs.

Geographic Impact

- Urban Areas: Buying is often more affordable due to high land costs.

- Rural Areas: Building may be cheaper, as land is more affordable.

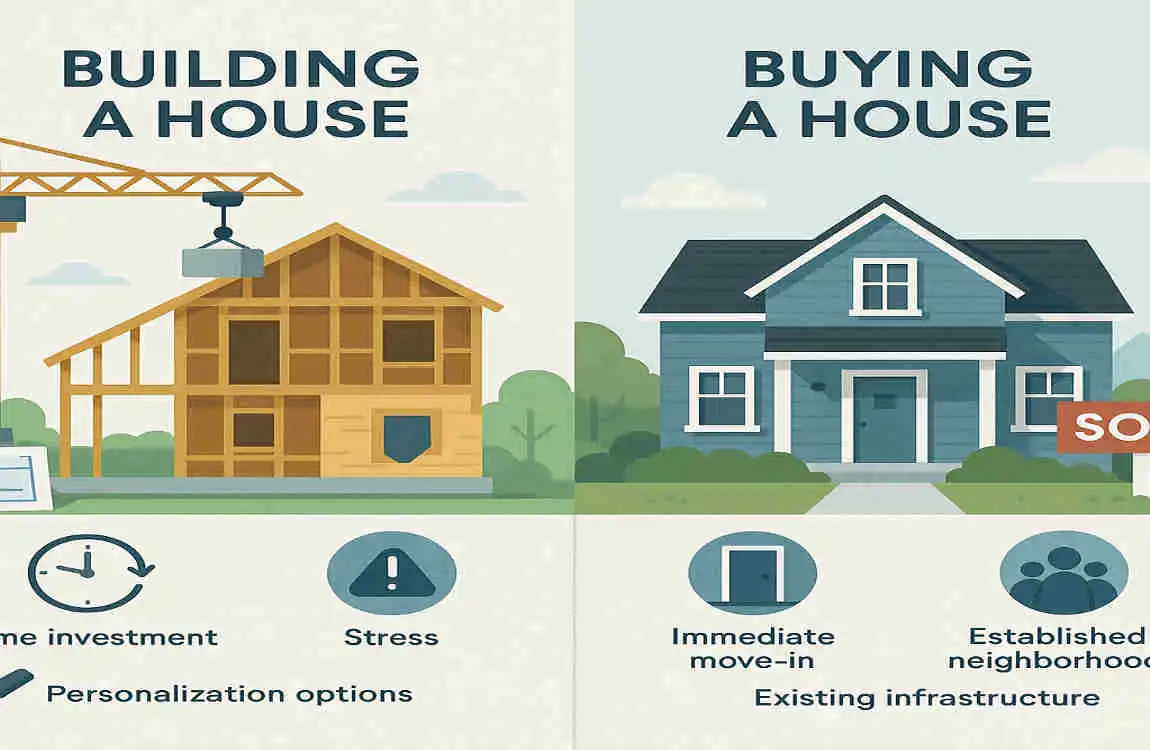

Non-Financial Factors That Affect the Decision

Sometimes, the decision isn’t just about money. Here are some non-financial factors to consider:

Time

- Buying is faster, while building requires patience.

Customization

- Building allows you to create your dream home, while buying limits your options.

Stress

- Managing a construction project can be overwhelming, especially for first-timers.

Expert Insights and Real-World Case Studies

Experts agree that the decision to build or buy depends on your financial situation, timeline, and priorities. For example:

- Case Study 1: A family in Texas saved $50,000 by building their home in a rural area.

- Case Study 2: A couple in California found it cheaper to buy due to high land costs.

Tools and Resources to Help Make the Decision

Here are some tools to guide you:

- Mortgage Calculators: Estimate monthly payments for buying.

- Construction Budget Calculators: plan your building costs.

- Professionals: Consult realtors, builders, and financial advisors.

Step-by-Step Guide to Deciding What’s Cheaper for You

- Assess Your Budget: Know how much you can afford.

- Research Local Costs: Compare home prices and construction costs in your area.

- Prioritize Your Needs: Decide what matters most—time, customization, or location.

- Get Estimates: Consult professionals for accurate cost estimates.

- Make an Informed Decision: Weigh all factors before committing.